The risks that cargo encounters as it crosses countries are limitless. Peril can present itself in many forms; such as rough weather and potential misplacement, amongst other kinds. Following the substantial investment required to supply cargo, it is safe to say that no freight owner dreams of having to face considerable expenses. That’s where cargo insurance comes in.

Cargo insurance, also known as marine insurance, gives owners peace of mind in terms of coverage against any risks which freight can encounter, whether it is accidental physical loss or unexpected temperature-related damage during transportation. Regardless whether the goods transported are cheap commodities or high-investment products, cargo insurance is never a decision which has been regretted, as it saves owners from tremendous financial burdens.

Never overlook the need of a contingency plan. Uncertainty will not protect cargo should these four occasions occur during transit.

CONTAINER LOSS AT SEA

Industry advances have not minimised the risk of container casualties and the latest statements show that there is a dramatic rise of such occurrences. With an average of 1,390 containers sunk each year worldwide, the odds are never in a cargo owner’s favour. The sea can transform into a raging beast during a storm and any detriment to cargo goes beyond a shipper’s control.

Cargo Damages

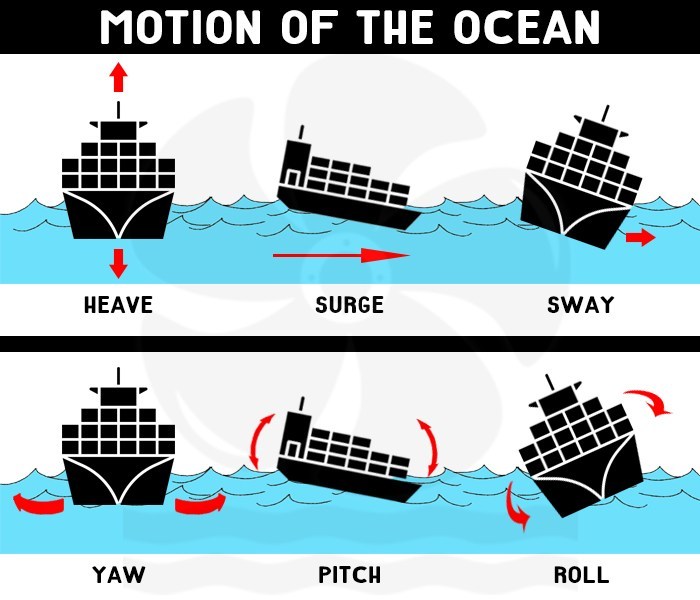

As cargo travels across the seas, the container vessel is thrust in different motions given the instability of the ocean ground.

Source: shippingandfreightresource.com

With different parties loading and unloading cargo, as well as its movement through several checkpoints, increases the chances of incurring damages, both physical and temperature-wise. It is the owner’s responsibility to ensure that optimal containers are selected for the cargo being shipped, cargo should be stacked well within the container, within optimal temperatures and adequate ventilation, to ensure no foreseen damages are experienced.

Theft

Advancements in technology have created more sophisticated crime methods. From piracy to the creation of fictitious identities, owners can easily lose control over their own consignments. Keeping distribution details classified protects cargo from being tracked down by criminals.

General Average

The term General Average has been part of maritime law since the late 1800s. It states that carriers can sacrifice part of the vessel or cargo in cases of emergency, to ensure full safety throughout the voyage. Given the extremity of the situation, the crew is not obliged to decide which cargo should perish based on its financial value, but randomly dispose of some containers to ensure overall safety.

The law dictates that a contribution is required by all freight owners to cover the expenses incurred during the emergency. Should costs run high, cargo owners are faced with substantial expenses, even if their cargo remained secure and untampered after the journey.

Cargo owners should ask themselves what it would mean if their goods get lost or damaged during transit. The answer would surely be alarming. Cargo insurance will provide a contingency should consignments face difficulties during their journey.

Thomas Smith offers freight forwarding solutions and insurance services that cater for your every need. Trust the experts in the field and benefit from ensuring all shipping requirements under one roof. For more information about cargo insurance, get directly in touch with our representative on [email protected].